Here is how payment and you can focus-only mortgage loans work in Ireland while the different methods to pay off your mortgage whether you are a first and initial time consumer, buy-to-help investor or switcher.

- Cost mortgage: The sum of you’ve lent, along with attention, is gradually paid back more than your chosen home loan name for the a month-to-month basis. Really domestic housebuyers pay its financing this way.

- Interest-just home loan: You can easily only pay the loan attention within the label plus the capital try paid off in a single lump sum payment towards the bottom. Get to allow traders get favor this option and it’s sometimes offered to worry about-developers to possess a small months.

What’s a fees financial?

It is a kind of financial for which you pay-off the bucks you’ve lent and you may one interest charged towards the loan more a beneficial place period.

Money is month-to-month and generally speaking pass on between twenty four and you will 3 decades*, even though this can be nothing because the 5 otherwise normally due to the fact thirty-five ages.

In the beginning of the identity, a greater share of your own commission are interest, yet not, when you get on end of the home loan label the mortgage is paid back totally and you will probably very own the house or property downright.

Cost mortgages benefits and drawbacks

- Cuts back your financial harmony

- Far more collection of mortgages

- Better to overpay

- A great deal more flexible

- Large monthly installments

- Less money to save or invest

What’s an attraction-simply home loan?

Its a type of financial open to purchase to allow investors inside Ireland. They might be no longer accessible to domestic individuals because they’re considered as well high-risk, whether or not care about-make mortgages is going to be given since the desire-only for the new generate months.

Having interest-simply mortgages, their month-to-month installment covers just the interest owed into the balance, perhaps not the administrative centre borrowed. This means monthly installments try lower, but you’ll still have to repay the initial loan on the conclusion the loan label.

To repay the administrative centre you will have to have a plan to pay off the bill at the end of the term – this can be called a fees means which you’ll need to remark sporadically.

Interest-simply mortgage loans pros and cons

- Lesser monthly installments

Version of installment approach

When you look at the Ireland, you will find several a method to pay off the main city you borrowed at the the termination of the borrowed funds label if you undertake a destination-only financial.

Property investment

Of many landlords prefer a destination-just financial because leasing earnings always discusses monthly attention and buy so that features was a long-term funding. An appeal-only mortgage also means lower overheads to possess landlords whom may require to maintain that or many features.

Purchase so that dealers normally make money of home price rises which is used to settle the administrative centre due, but this isn’t secured and you will utilizes a healthier houses field.

Endowment policy

An enthusiastic endowment rules is a kind of capital removed which have a life insurance organization. Cash is paid down into the policy every month getting an appartment period of time, hence cash is invested.

The insurance policy will pay aside a lump sum in the bottom of your own identity together with fund are accustomed to pay new an excellent home loan harmony. However, the worth of an endowment plan hinges on brand new money out-of the newest loans. If the a keen endowment works badly it might not be adequate in order to pay off what exactly is owed.

Retirement financial

Pension mortgages are like endowment mortgage loans, yet not, a retirement cooking pot supporting the loan as opposed to an endowment plan. The newest swelling-sum an element of the pension is employed to repay the loan resource after the phrase, set to correspond with advancing years.

If you find yourself a purchase so that buyer and you will given an attraction-merely home loan, you could wish to imagine taking financial pointers to simply help set your installment approach.

Would you alter notice-in order to a repayment financial?

Yes, you might constantly re-home loan and you will change to a payment financial, providing you fulfill all lenders’ cost requirements.

Switching to a payment mortgage increases the monthly obligations. To keep your costs affordable, you may want to consider extending your home loan identity but bear in mind you’ll shell out alot more focus along the name of the financial if your help the label.

Another option would be to circulate element of what you owe on to a beneficial repayment mortgage and then leave some in your present interest-just mortgage.

Can you imagine you simply can’t pay your own home loan?

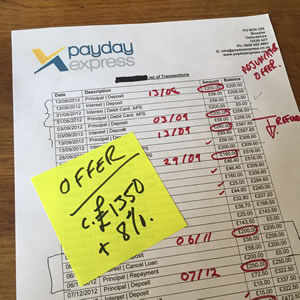

Within the Central Financial regarding Ireland’s Code from Conduct into Home loan Arrears banking companies need certainly to set in place a process known as Financial Arrears Quality Process (MARP) to simply help customers whoever financial is within arrears or perhaps is on danger of going into arrears.

The lender has to offer you an alternative payment arrangement and you will officially review the arrangement at the very least all the six months. This comment includes checking if the products enjoys changed while the beginning of the plan otherwise since history opinion.

Option cost preparations

Moratorium or repayment crack: This allows you to definitely defer paying the otherwise element of your mortgage to own a concurred, limited time. At the conclusion of new deferment period, your instalments increase. If for example the repayments try below the interest count owed, your financial support equilibrium also increase.

Capitalisation off arrears: In which your an excellent arrears can be placed into the rest financing equilibrium, enabling you to pay off them each other along the longevity of your mortgage. This means that your financial won’t enter arrears but this can increase the investment and you will attention money across the overall life of their home loan.

Home loan title extension: This enables one lower your month-to-month money but your mortgage lasts longer. It will end in you spending significantly more attention across the lives of mortgage this will definitely cost significantly more altogether.

Interest-merely plan: That is where you have to pay just the interest on your home loan find out here having a specified minimal time frame. It means your financial support harmony does not dump in the plan plus month-to-month costs will increase because arrangement several months has actually finished.

Region funding and you can focus arrangement: This enables one to pay the complete attract on your own home loan also build part money to your mortgage equilibrium to have the remaining name of your mortgage.

Broke up financial plan: Which plan breaks your home loan to the one or two profile to attenuate the monthly payments. You’ll be necessary to build financing and you can focus payments predicated on your current financial things for starters region and the almost every other region is warehoused and percentage try deferred to have an occasion up to the monetary products boost.

After the loan label, new a good home loan harmony would be due long lasting solution repayment plan.

If you’re not capable pay off the latest a good home loan in full, make an effort to talk to your lender in regards to the choice available, that may include, downsizing your property, financial to rent, or promoting your property.

If you find yourself troubled financially or are involved about your financial, speak to your financial or even the Currency Pointers & Cost management Service to express the options.