It’s a cost-effective way to get the bookkeeping that will make tax time easier and help keep you from audit issues. It also puts the reports you want at your fingertips, so instead of using your time to enter data, you can spend your time thinking about how to grow your business based on real data. QuickBooks Live Bookkeeping is a comprehensive bookkeeping service that businesses can contract with to maintain their books, properly categorize expenses and perform reporting.

Best Accounting and Bookkeeping Apps for Small Businesses

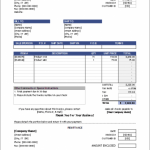

Other more advanced features include the ability to create separate tax codes for different line items in invoices, track inventory and assign production stages to items. Established businesses will start their engagement with QuickBooks Live Bookkeeping’s cleanup services. This step ensures your books are accurate and up to date when your ongoing monthly bookkeeping service commences. Inventory aside, you can choose from a variety of invoice templates, add custom fields and automatically calculate taxes. The platform also lets you accept online invoice payments via card or PayPal, but note that you can’t exceed 25 invoices per month with the free plan.

Mobile app and cloud access

While major review sites don’t often mention QuickBooks, a quick scan of forums dedicated to accounting and QuickBooks usage reveal frequent frustration from customers. Many customers state that the QuickBooks Live’s “cleanup” left their books messier than before. One accountant there even jokingly referred to QuickBooks Live as their “marketing team,” as he finds himself fixing so many of their errors.

About cookies Manage cookies

With the subscription, the small business is connected with a dedicated bookkeeper who is available to work on the account virtually. There is a cleanup fee to get started and get your books in order, and then pricing drops to the monthly fee of $200 to $400. Read our comprehensive QuickBooks Live Bookkeeping review to decide if this popular managed service is right for your business.

Tax Relief Companies

With the Simple Start plan, QuickBooks’ software will generate cash flow statements, income statements and balance sheets. Users can also use it to create customized tags and reports that help you hone in on specific income and expense trends and up your business’s cash flow. Higher-tier plans include more thorough reports and in-depth insights, including https://www.wave-accounting.net/ profitability reports, extended forecasting and inventory reports. With a no-frills small business focus, Bookkeeper may not be the flashiest service, and offers no proprietary software integrations, but all signs point to their dependability. I’ve been a bookkeeper and tax preparer for a few years and use QuickBooks as my main accounting software.

- It’s a cost-effective way to get the bookkeeping that will make tax time easier and help keep you from audit issues.

- You can cancel your QuickBooks Live plan or upgrade from Live Expert Assisted to Live Expert Full-Service Bookkeeping at anytime.

- Online business debt management has become widely popular because it meets the specific needs and challenges faced by …

QuickBooks Online Essentials

While QuickBooks’ inventory management software isn’t the most advanced inventory option out there, it’s perfectly functional. Plus, Quickbooks’ thorough integration library ensures users can find inventory tracking software that both meets their needs and integrates with their accounting software. QuickBooks Online Essentials costs an additional $25 per month, which adds features like bill management and time tracking.

QuickBooks Self-Employed tackles basic freelance bookkeeping features like expense tracking, receipt uploading, tax categorizing, quarterly tax estimating and mileage tracking. A QuickBooks live bookkeeper is a dedicated bookkeeper provided to your business through the QuickBooks Live subscription. They categorize expenses, reconcile accounts and close your books for you as needed. QuickBooks Live, Decimal and Ignite Spot Accounting are three competitors that offer subscription bookkeeping services. All three boast a dedicated team to ensure that your bookkeeper learns about your business and what makes it tick. QuickBooks Live Bookkeeping is a subscription service that gives a business a certified bookkeeper to help manage the company books.

The dashboard gives you quick insights, like money owed to you and cash flow. It’s a plus whenever free products come with reporting capabilities, but Brightbook offers fewer reports than some competitors. Because it’s a single-entry system, for example, you won’t find a balance sheet.

We collect the data for our software ratings from products’ public-facing websites and from company representatives. Information is gathered on a regular basis and reviewed by our editorial team for consistency and accuracy. You can use Brightbook’s free accounting software to send quotes to clients, convert them to invoices, bill for time, add discounts or taxes and accept payments through PayPal. Consider it if you’re just starting out on your small-business journey but anticipate substantial growth over time. (It’s our top pick for startup accounting software.) If you’re tech savvy and tend to work on the go, you may benefit from Zoho’s mobile app and unique features. Consider it if you’re a small business with simple accounting needs that are generally concentrated in sending invoices and collecting payment.

In the realm of business operations, even the smallest details depletion expense definition types formula can have a significant impact on efficiency and cost savings.

They will also help you with ongoing, basic bookkeeping and QuickBooks questions, like how to use QuickBooks’ reporting features, assistance with bank connections, and setting up customers and vendors. Your QuickBooks Live Bookkeeper will not send invoices, pay bills, manage your inventory, or provide tax or financial advisory services. Another advantage of online bookkeeping services is that they offer real-time data tracking and reporting.

Your bookkeeper takes the lead on your bookkeeping and runs essential reports so you can focus on your business. Free business software can be the right choice if it covers your financial, payroll, inventory, sales or other needs. The best choice will depend on your specific industry, budget and growth trajectory. But if a free product doesn’t make it easier to run your business, a paid option will likely be the better choice to save you time and help ensure accuracy.

Wave can also generate the most important financial statements (profit and loss, balance sheet and cash flow statement) along with reports on sales tax, payroll, aged receivables and aged payables. Free accounting software helps small businesses keep track of where their money is coming from https://www.business-accounting.net/expense-definition-meaning/ and going to. The best options cover the basics in some combination of features, including double-entry accounting, income and expense tracking, invoicing, online bank connections and third-party integrations. QuickBooks Online’s two higher-tier plans include basic inventory management.