How to Manage Business Finances: A Comprehensive Guide Bloombergz-Global Finance and Business Insights

We accept payments via credit card, wire transfer, Western Union, and (when available) bank loan. Some candidates may qualify for scholarships or financial aid, which will be credited against the Program Fee once eligibility is determined. Please refer to the Payment & Financial Aid page for further information. Now that you’ve done some research on basic finance skills for managers, it’s time to take the leap to build out those skills. The income statement—sometimes called a profit and loss statement, or P&L—is a document that outlines your business’ income and expenses over a set period of time. By developing basic finance skills, you can understand how your actions impact your organization’s finances, but also advocate for yourself and your team when weighing in on company-wide financial decisions.

Monitor cash flow religiously.

Often, your small business is successful because of your expertise in making your product or providing your service. Unfortunately, you might not be an expert at the other important parts of running a business, such as managing finances. If you don’t have a lot of experience with managing business finances, it can be a challenge, but it’s also crucial to the survival of your business. Here’s how to establish responsible financial habits that put your business on the road to success. The first step is to choose payroll software with direct deposit, which transfers your team’s pay directly to their bank accounts.

Pick a method of accounting

- The app is primarily used for personal expenses, but it can be used for business expenses as well.

- Look, you may be an expert in your field, but when it comes to financial expertise, we can all use someone with expertise to guide us and hold us accountable.

- “If you’re not looking five to 10 years ahead, you are behind the competition,” said Tina Gosnold, founder of QuickBooks specialist firm Set Free Bookkeeping.

- You simply need to be able to identify the trends and red flags—such as unusual gains or losses—that tell you if your business is healthy or in trouble.

And each of these dimensions is necessary just to start the analytics journey. While degrees in business administration and finance differ in their details, both can lead to lucrative careers with both small and large companies. Getting a degree in finance also gives students a chance to learn more about investing.

Choose an accounting method

Setting aside three to six months’ worth of operational expenses can help tide your business over during financial snags. That’s a lot of cash to have on hand, but saving a little at a time, perhaps 10% of your income in a separate high-yield business savings account each month, can help you reach your goal. Once you have a business account, it’s important to pay yourself on a regular basis. For example, S-Corp owners will need to use a formal payroll system, while sole proprietors can simply transfer money to their personal bank account. It’s not just about making money—it’s about smart, strategic growth that ensures long-term success and creates a ripple effect of wealth and opportunity. Together, we can break down the barriers that women face in the business world and build a future where female entrepreneurs not only thrive but lead the way in economic growth.

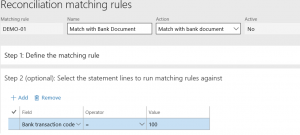

Open bank accounts for your business

Understanding the tax code and taking advantage of deductions and credits that are available to you can make a big difference to your bottom line. Tracking the right business metrics is crucial for understanding the health of your business. Businesses often use either the accrual or cash methods of recording purchases. The accrual method puts transactions on the books immediately upon completing the sale. However, wire transfers are irreversible once initiated, making it crucial for senders to double-check the recipient’s details and remain vigilant about common scams and what they look like. Based in Madrid, IE Business School offers outstanding bachelor’s degrees, master’s programs, PhDs and executive education.

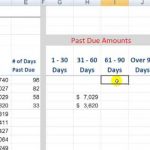

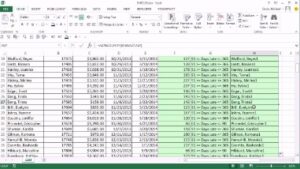

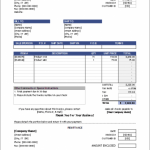

Improving the way you manage inventory can help you manage money in your small business. An accounts receivable summary shows you which customers owe your business money, the amount due, which customers are past their due dates, and your total receivables. Record when payments are due and set reminders so you don’t fall behind. Pencil in due dates on a paper, phone, or computer calendar and get on a consistent payment schedule.

The person you choose should be a certified public accountant (don’t assume every accountant is) and licensed to practice in your state. You can ask if you can call a few clients to check references and make sure you are clear about what is a qualified retirement plan the individual’s fees for services. Every business faces risks, but with proper risk management strategies, you can minimize their impact. Identify potential risks, create contingency plans, and ensure business continuity.

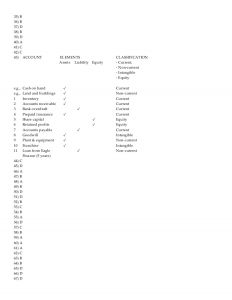

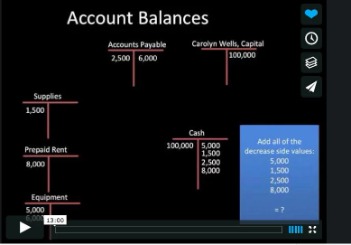

For accurate accounting results to be measured and reported, accurate bookkeeping must occur. Both tasks require numbers and attention to detail to succeed, but their main differences lie in how the numbers are arranged on a scale. Bookkeepers focus on tracking financials on a day-to-day level, while accountants use these financials to create an overall picture, look at long-term goals, and stay up-to-date with all regulations. Whether you’re looking to start a business or want a clear understanding of your finances, mastering the difference between bookkeeping and accounting is essential for anyone interested in finance. Managing a business is no small feat, as it requires an adept understanding of financial systems and processes. Knowing the basics of business finance management can feel overwhelming to many business owners, but it’s essential for the success of any business.

In 2023, you can contribute up to $22,500 to your 401(k) and $6,500 to your IRA. Plus, if you’re 50 or older, you can make “catch-up” contributions of $7,500 and $1,000, respectively. Kody Wirth is a content writer and SEO specialist for Palo Alto Software—the creator’s of Bplans and LivePlan. He has 3+ years experience https://www.quick-bookkeeping.net/who-files-schedule-c-profit-or-loss-from/ covering small business topics and runs a part-time content writing service in his spare time. Analyzing your profit and loss statement can help you determine which aspects of your business are profitable. Investors and lenders also review your profit and loss statement when deciding whether to invest or lend to you.

Meanwhile, forecasting allows you to predict future income and expenses, helping you make informed decisions about growth opportunities and potential investments. Regularly reviewing and adjusting your budget and forecasts ensures that your business remains on solid financial footing. In many organizations, the Chief Financial Officer (CFO) plays a central role in managing business finances. They provide strategic financial leadership, oversee all financial operations, and make crucial financial decisions that shape the company’s financial trajectory. Given their potential importance for navigating the financial seas of your business, it’s a good idea to learn how to outsource your CFO so that your organization can easily coast through any economic turbulence.

Managing your business finances is critical to keeping your small business running smoothly and making informed decisions. Through debt financing, you can quickly access capital that you might not otherwise be able to get for weeks or even months. Bank loans, government loans, merchant cash advances, business credit lines and business https://www.quick-bookkeeping.net/ credit cards are all forms of debt financing, which you must repay even if your company fails. Every business owner has a client that is consistently late on their invoices and payments. Managing small business finances also means managing cash flow to ensure your business is operating at a healthy level on a day-to-day basis.