Finance and Accounting Business Process Outsourcing FAO

By using best practices and modern software solutions, they should be able to fill all your finance and accounting gaps, as well as learn the uniqueness of your business. With Consero as your partner, we will be able to bridge the gap between your organization’s financial goals and numbers together and increase your https://www.quick-bookkeeping.net/the-difference-between-depreciation-on-the-income/ financial visibility. Furthermore, you’ll get the opportunity to strategically outsource your accounting while maintaining a core finance team. The outsourced finance and accounting industry continues to demonstrate its value to companies of all types and sizes, which is why it has begun to secure their trust.

What are the benefits of outsourcing finance and accounting?

Having a skilled eye on your finances at all times will give you peace of mind, as well as the ability to make well-informed financial decisions. Like with a controller, whether https://www.adprun.net/ or not you’ll need a full accounting service depends on the size of your business. The decision to outsource your company’s finance and accounting needs is enormous.

Top 10 Best HR and Payroll Systems for Your Business

When bookkeeping tasks become too time-consuming to handle on your own, hiring an online bookkeeping service can be a worthwhile investment. These services are typically staffed by people who have access to your accounting software and help make sure none of your financial data slips through the cracks. To make important business decisions, leaders need access to timely, precise financial data. An outsourced accounting firm provides exactly that with real-time financial dashboards, monthly reports, support with long-term financial planning, and more. LBMC is a Tennessee, Kentucky and Indiana CPA firm dedicated to helping entrepreneurial businesses excel. We provide a wide range of outsourced accounting services to clients in a range of industries.

Intelligent Operations blog

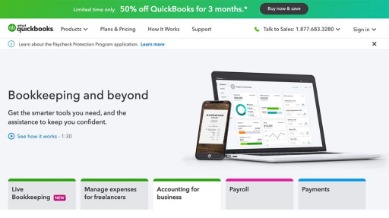

Our Founder & CEO, Matt Garrett started and sold several companies before founding TGG. He created the TGG Way™ which provides companies with the insights and experience from those ventures, giving them the financial clarity they need to succeed. Cash flow forecasting allows a company to do strategic planning with confidence despite annual fluctuations in cash flow. No cap on meetings with your bookkeeper; QuickBooks says small-business owners usually schedule one or two video appointments per month. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research.

Yes, virtual and outsourced bookkeeping is just as legitimate as in-house bookkeeping and accounting. However, as with any in-person accounting professionals you’d trust with your financial data, you should always verify a bookkeeping firm’s credentials before committing to a monthly plan. And on the accounting software front, Bookkeeper360 syncs with both Xero and QuickBooks Online. Looking for a scalable outsourced bookkeeping service with flexible payment options?

Contact us to learn more about our services

Running your own accounting firm or tax preparation service is a stable and rewarding career. People will always need help managing their finances, so there’s never a shortage of clients, and depending on the season and the services you offer, it could turn into quite a lucrative career. No matter the size of the business or service you are offering, there will be some degree of financial responsibility that you need to take care of. Using a professional external accountant rather than hiring a part-time or full-time accountant onto your team and potentially can save you thousands per year.

And since your team may be working from a different time zone, you may be able to extend your company’s operational hours and further boost your financial activities’ efficiency. Now that the cost of outsourcing is less than the pay of one financial executive, many companies are beginning to outsource their finance and accounting operations more frequently. Cutting overhead and getting better financial leadership is critical to the success of all companies. By understanding where the industry is currently and where it is moving, you’ll be able to decide whether outsourcing is the right decision for your business.

Below are common industries that have successfully implemented an offshore model. Get local insights relevant to your area of specialization, learn what others have done in your industry and leverage their experience. As the largest managed operations offshoring provider in the Philippines, we’ve learned a lot.

- We have helped transform the Finance & Accounting Business Process Outsourcing related processes of over 100,000 finance practitioners in over 80 countries.

- In the future, companies that don’t automate their finance departments may experience miscommunication and disorganization, leading to decreased productivity.

- Outsourced accounting services have become a more common and practical solution for various businesses today.

- Read what their past clients have to say about the finance provider’s quality of work, performance, and employees, and use those impressions to narrow down your choices to 2-3 companies.

- An outsourced accounting firm provides exactly that with real-time financial dashboards, monthly reports, support with long-term financial planning, and more.

Companies looking to sell must have impeccable finances to get their full valuation. TGG’s GAAP compliant reporting gives buyers confidence in the value of your business. Contact us with a brief description of what services you’re interested in and how we can help you.

Our technology can automate and integrate your transaction workflow, giving you real-time visibility into your business and freeing you to concentrate on your core competencies. Increase your desired income on your desired schedule by using Taxfyle’s platform to pick up tax filing, consultation, and bookkeeping jobs. When you use Taxfyle, you’re guaranteed an affordable, licensed Professional. Taxfyle connects you to a licensed CPA or EA who can take time-consuming bookkeeping work off your hands. You can connect with a licensed CPA or EA who can file your business tax returns. FreshBooks can help you find an online accountant nearby who is ready to help your endeavour grow and succeed and fulfil all your accounting needs.

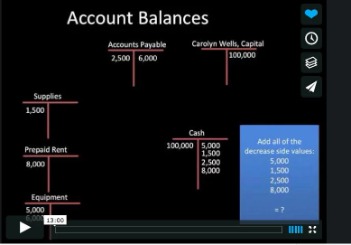

There are numerous resources and teaching materials online that can provide you with a better understanding of what is needed to do the job right. This includes QuickBooks, which offers bookkeeping courses and certifications that grant business owners a solid foundation 4 inventory costing methods for small businesses of financial knowledge to help them succeed. A team of accounts can help you through your quarterly tax requirements and annual tax filing. Instead, a bookkeeper should track everything in a program like QuickBooks to hand over to your accountant when the time comes.

When you outsource, you can leverage the expertise and experience of firms who are already established in those markets. This ensures that your tax and legal obligations are being handled by local accountants who understand local tax laws and regulations, and who are sufficiently qualified. Managing financial accounts, from bookkeeping to financial reporting, to managing invoices remains a pivotal aspect of any business strategy. Yet, this task can be time-consuming and challenging, especially for SMBs lacking dedicated financial professionals. Customize plans to include other services like accounts receivable processing, inventory reconciliation and payroll support. Leverage the power of an outsourced accounting team to build more efficient workflows and accelerate turnaround times for clients.