First of all happens try how much cash I shall shell out inside the desire?. Exactly what throughout the all the details which go towards the this choice?

step one. How much cash would you like? This will be perhaps one of the most very important questions you need to wonder whenever determining though you should get individual funds. You’ll want to know precisely what sort of mortgage your need.

dos. What sort of interest have a tendency to implement? The higher the interest rate on your own financing, the more currency it’ll cost you in notice repayments over time and is not at all something anybody desires!

step 3. In the end, it can also end up being of use for individuals who talk to a person who has already established feel taking out fully a personal bank loan prior to making people latest decisions on the whether or not that is something which create benefit your situation immediately.

Consumer loan Options for the fresh Unemployed

When you are employment seeker or if you lack a formal revenue stream, you might be concerned with what you can do to track down personal loans. It’s true one particular loan providers is reluctant to render loans to those with started out of work for some time or people who do not have a steady source of income. But it is perhaps not impractical to get one.

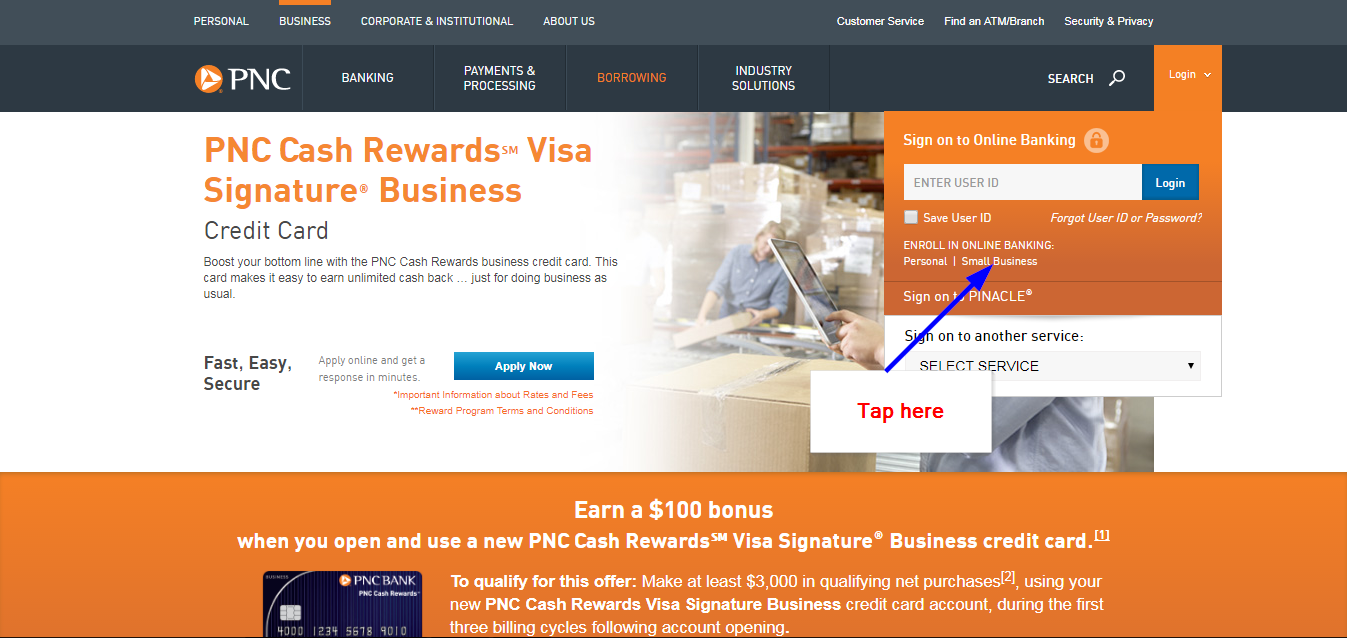

Credit card Payday loans

A charge card pay day loan are a loan which you bring out utilizing your charge card just like the equity. You can get a maximum of $five-hundred 30 days on the credit line, however allow it to be way more. The mortgage number you might acquire depends on your own credit limit as well as your earnings. The speed during these funds is oftentimes high, making it crucial that you utilize them moderately.

Peer-to-Fellow Finance

Peer-to-fellow lending are a fascinating style of money which enables investors to help you lend currency to help you unemployed consumers in person, without the need to read a bank or any other lender. This is accomplished via the internet, that makes it possible for unemployed individuals and payday loans without checking account or savings you can lenders to connect along.

Finance from Family unit members or Friends

When you have a member of family or friend who is happy so you can provide you the currency need, one may work out a loan arrangement that can work with both sides.

If you are considering borrowing funds from a family member otherwise friend, you can find issues that you have to keep in mind in advance of getting into such as an arrangement. To begin with, it is crucial that each party agree with exactly how much interest might possibly be recharged into financing and you can exactly what terms and conditions have a tendency to implement if an individual cluster try not to pay-off their loans immediately after a certain several months of time.

Vehicles Term Financing

A motor vehicle name loan happens when you have made that loan up against the worth of your vehicle. You devote your car while the collateral, therefore borrow funds resistant to the worth of the car. Vehicle identity money are either named label pawns and you will buy them in a single business day.

To obtain an automible title financing, you ought to have a motor vehicle which is well worth at the least once the much as what you want to acquire. If it is not value sufficient, then you certainly most likely never be eligible for a car or truck identity financing.

Domestic Guarantee Credit line (HELOC)

A house equity line of credit, otherwise HELOC, is actually a guaranteed mortgage which enables one to borrow secured on the newest security of your house. Its one of the most flexible sort of loans since you are able to use it for anything from paying credit card debt to purchasing another automobile otherwise remodeling the kitchen.